Save Like A Boomer

Because they have money ...and we don't.

How does your bank account look?

…yeah, same friend.

With the value of the dollar dropping, and inflation outpacing bank account yields the idea of saving, let alone growing your money right now… sucks.

The global economy is looking about as bright as a babies soiled diaper. And if you’re here that means you’re looking at other options to save your money.

Recently I had a family member reach out to me interested in investing in crypto. Having invested in it myself with success, it’s an area I know well and am even still in.

I knew immediately which crypto assets would be best for her level of experience, which was of course zero.

But I also suggested she look at something else.

Crypto, like stocks, has a steep learning curve and is extremely risky. So when you’re goal is just to park some money somewhere it will grow. it’s a hard sell.

Even with Bitcoin, the “safest” asset in the space, the fluctuations in price that occur daily will churn your stomach like the Velocicoaster right after dinner.

My best money saving recommendation to you right now, is to save like a Boomer. They parked their money into something that has practically printed them money. You should to.

Now when I say printed them money, I’m not talking about like in a copy machine. The government has been doing that already. Look where we are.

I’m also not talking about stocks or real estate.

The something I’m talking about not only retains it’s value, but increases in value over time.

Sound like crazy voodoo magic? It’s really not. In fact it used to be the only way to save for… literally centuries.

I’m talking about precious metals.

Wait Wuuuut?

Yeah, I hear you. Not what you were expecting right? I know. But hear me out, and let me start from the beginning…

“Traditional” Savings

When you think of saving these days, the most common answer is find a high yield bank account put money in and pretend it doesn’t exist.

The idea here is that the yield paid by the bank will cover the inflation of the currency so that when the day comes for you to withdraw that money, it will still have the buying power it did when you put it in.

That’s the idea. Now let me tell you about the problem.

In 2022 inflation hit 9.06% (inflationdata.com) No bank account in America was paying a yield that high. If you know of one that was, let me know. I’ll wait.

High yield accounts, when you can find them, are around 3% to maybe 5% and that’s when markets are good. And no, markets are not good right now.

Here’s the other problem. Even if you find a good, high yield account. They change it when they need to so that it matches the current conditions of the market. You might start with a nice 5% yield account and then a month later have it dropped to 2% due to economic conditions.

But let’s say that doesn’t happen, and the yield does stay ahead of inflation. Guess what? You get to pay taxes on it. Yay! Kiss those inflation beating earnings goodbye.

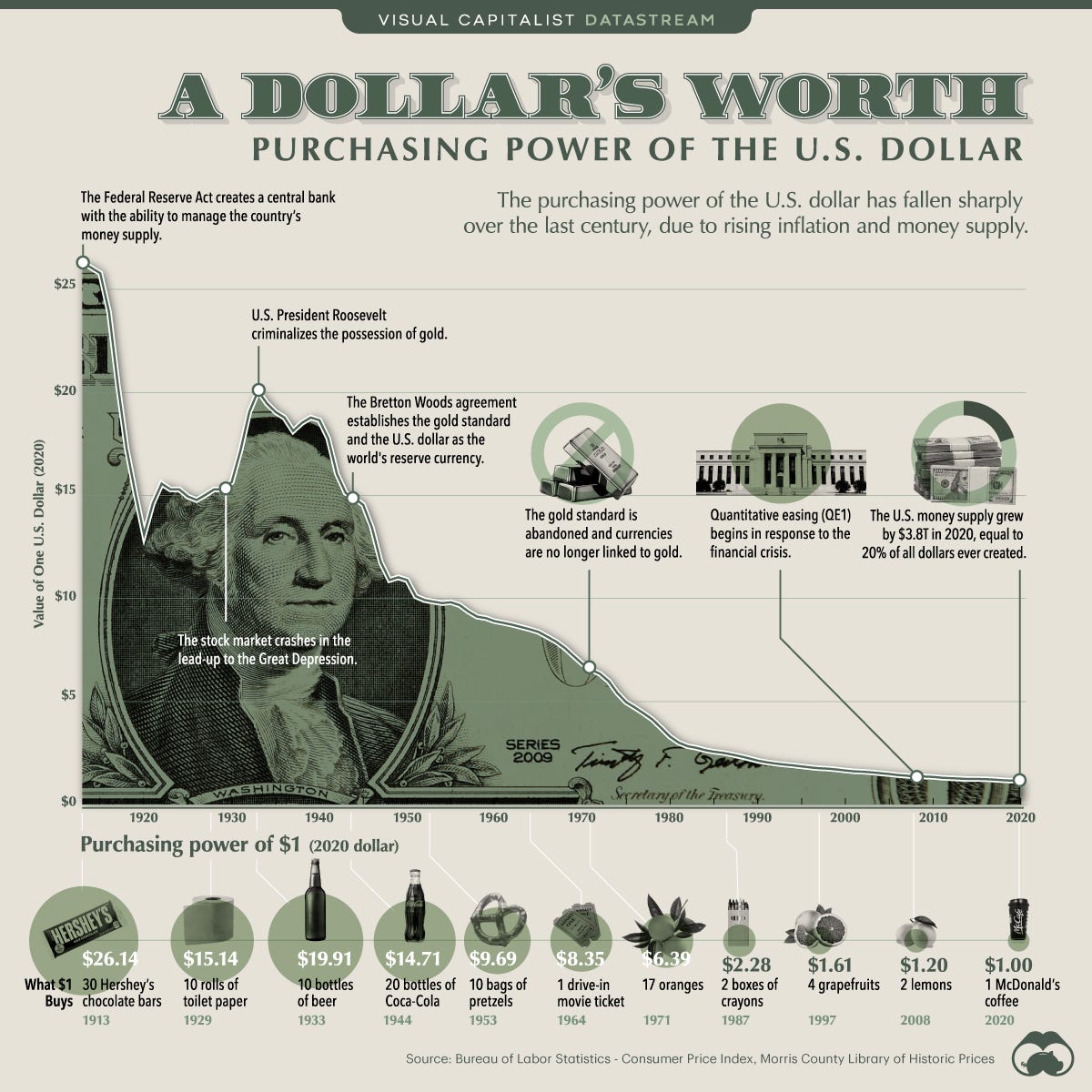

Just to illustrate just how bad inflation is these days, here’s a visual that illustrates it perfectly.

What’s more scary than the chart above? It only goes to 2020. With all the printing that occurred from 2020 to 2022, it’s way worse now.

Precious Metals - So What Exactly Are they?

Don’t let the fancy name get to you. When someone starts talking about precious metals, they’re usually talking about Gold and Silver, also called Bullion.

So why Gold and Silver?

Simple, because it’s a limited resource. Why does that matter? Let me explain.

The buying power of the dollar is dropping because of what I mentioned earlier, the government keeps printing it. Or more accurately in our digital age, they add a few zeros to a bank account and then issue checks. Yes, seriously.

But there was a time that the dollar was tied directly to gold. And in terms of the scope of time, it wasn’t all that long ago either.

Then the gold standard was set, instead of money being tied 1:1 with their precious metal counterpart (Gold,) the value was arbitrarily pegged to an amount of Gold.

I know that sounds like I’m saying the same thing, but bear with me…

Before the change if $1 = 1oz of gold, the Federal Reserve had to keep that amount on hand. And if you went to the bank to redeem it, that’s what you would get.

After the change the government had the ability to say that $100 was the equivalent of 10oz of Gold. But remember they could change the values on either end however they wanted.

This standard didn’t last long. Less than 30 years later, the government changed the system again and simply said that the dollar is valuable because we say it is.

If you think I’m being dramatic about that, note that the name of this monetary system is fiat, which in Latin means “an arbitrary act or decree.” (Investopedia.com, Merriam-Webster)

What I’m suggesting you do instead of keep your money in an arbitrary value system is to put it in something actually worth something. Silver and Gold.

Here’s an interesting fact about Boomers savings:

As of the end of June, American boomers had accumulated a staggering $80 trillion of wealth, according to Federal Reserve data. That’s more than half of all household wealth in the nation, despite boomers only making up about 20% of the U.S. population. (2024 - Nasdaq.com)

That’s insane. Now to be fair, it wasn’t all in Silver and Gold.

The reason I highlight boomers in this article is because in their time they put away their money in assets that were stable, hedged against inflation and that would yield a large return over time.

Right now in our time the assets doing that are Silver and Gold.

Real Estate requires a large up-front cost that most of this generation can’t afford. Crypto is extremely volatile and it’s future is still uncertain and with the current political scene, stocks feel nearly as volatile as crypto at the moment.

Gold and Silver on the other hand continue to do what they’ve been doing for over 100 years. Increasing in value. Gold is heavily used in electronics and both Gold and Silver are used in jewelry the world over, so this won’t be changing anytime soon.

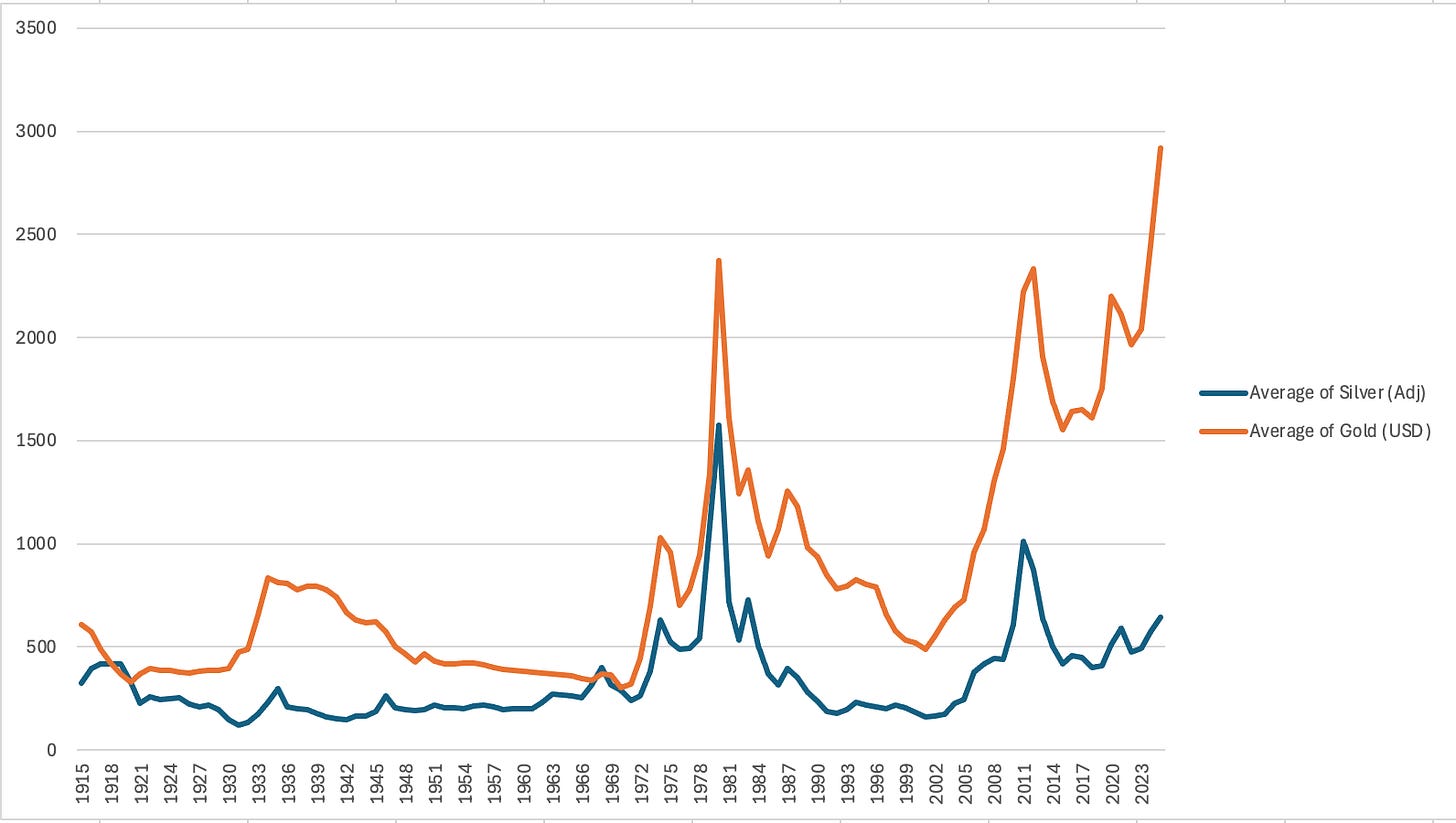

But no need to take my word for it, here’s a graph that shows their value averaged year over year since 1915.

Now I’m going to take this a step further and tell you what in the world of precious metals is even more, dare I say it, precious. Gold and Silver collectible coins.

What? Collectible Coins?

Yes, collectible coins.

Now before we go any further, and before you go searching the internet for where to find Gold and Silver collectible coins, please know that it’s important to get them from a reputable source.

These get minted by both the government as well as independent companies. The industry is highly regulated due to it’s nature. To even get contracts with these companies requires a net worth of 1,000,000,000 (yes, one billion dollars.)

So you can imagine that not to many people or companies actually meet that criteria. Thus scammers abound. Ok, now back to what I was saying…

You’ve heard of people collecting fine art?

The reason they do is because fine art does remarkably well not only holding it’s value, but depending on the artist, can skyrocket well above the base value simply because of the popularity and demand of the artist. Plus you get to hang it on the wall.

The same principle applies to collectible Silver and Gold coins. You get the base asset as a store of value against inflation, then depending on what is printed on it, get the benefit of additional value provided as a collectors item.

Because of this and the fact that they are a tangible asset that you yourself can take full custody of, it’s what I myself put my savings into.

It’s the present day gamification of precious metal asset accumulation.

You can get the upside of crypto in terms of upward price swings and liquidity but the stability of an asset like real estate. All without massive up-front cost and without the massive risk of losing it all.

Do you know of another way to save and invest where the only thing you have to lose, is your net worth goes up?

If you want to save for yourself and your family in physical assets you can touch and hold, and that increase in value over time… And have all your purchases be tax deductible, then DM and I’ll give you all the details to get started.